Inheritance tax can place a huge financial burden on your loved ones. These steps summarised below can help you manage your estate, so more of your wealth goes to those you wish to benefit.

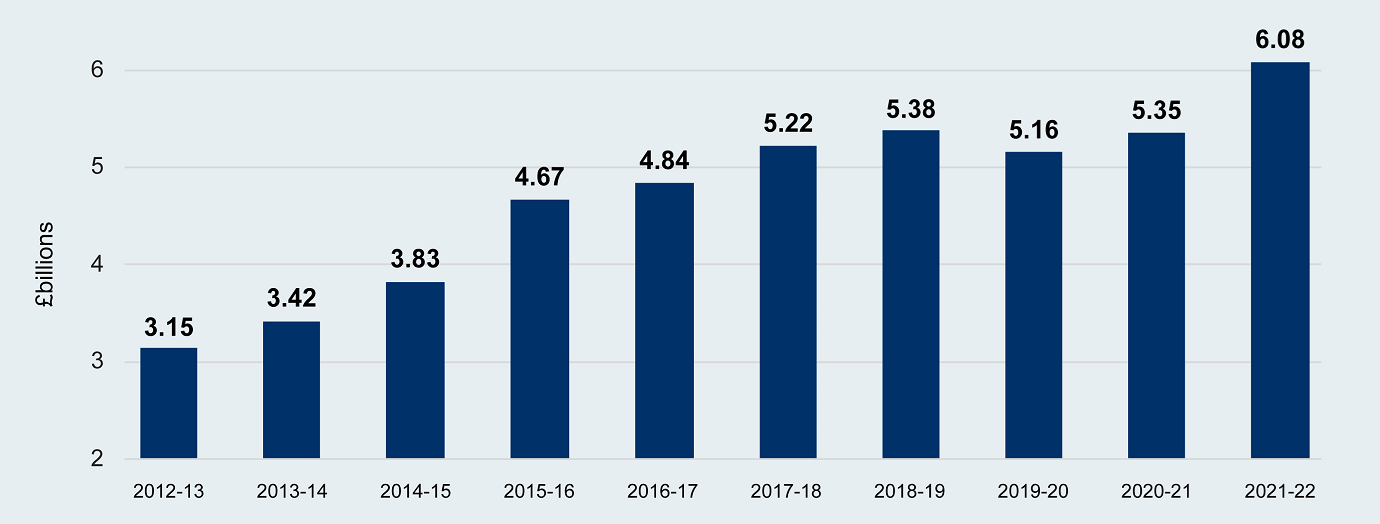

Families in the UK paid a record £7.1 billion in IHT in the financial year 2022/23 – more than double the £2.9 billion paid in 2011/12.

It’s a staggering rise, driven largely by sustained property price increases and a long-term freeze of the IHT threshold.

UK IHT receipts rise as frozen threshold and asset price inflation bite

Source: HMRC

How much inheritance tax should you be paying?

In the UK, a zero percent rate of IHT, known as the nil rate band, is applied on assets up to £325,000 per person. If your estate is worth more than £325,000 when you die, any assets beyond that figure may be subject to a flat IHT rate of 40 percent. Any unused threshold may be transferred to a surviving spouse or civil partner, increasing their combined threshold to up to £650,000.

Individuals may also benefit from the additional residence nil rate band of £175,000, where property is left to direct descendants. Similar to the nil rate band, any unused amount can be transferred to a surviving spouse, increasing the combined nil rate threshold to a possible £1,000,000. However, the additional residence nil rate band is tapered for estates worth more than £2,000,000, and therefore withdrawn entirely if a married couple’s combined estate is worth more than £2,700,000.

The UK’s IHT threshold has been frozen since 2009, which has resulted in significant fiscal drag. If the threshold had moved in line with the Retail Price Index’s level of inflation – one of two main measures of UK consumer inflation – an individual would now be able to pass on more than £407,000 without incurring IHT. Projected forward to tax year 2027/28, and that figure would be over £500,000.

But what exactly comes under the scope of IHT?

IHT is applicable to everything from property – your main residence, holiday homes and rentals – to your money, personal art, jewelry, vehicles and other investments.

“There are some people who will be happy to pay any IHT liability, as their money is going to HMRC and helping those less fortunate,” says Chris Black, Head of Financial Planning for RBC Brewin Dolphin – Newcastle. “But the majority of estate owners who have children, and charitable causes that are close to their heart, will want to mitigate its impact. This means starting the process as soon as possible.

So how can you limit your IHT bill and pass on more of your wealth to the people you love?

- Gift the money

Gifting money can be a tax efficient solution to limiting your IHT liability. Yet 62 percent of individuals we survey are concerned about how to gift properly.

“Many of our clients employ a gifting strategy to offload their wealth in a controlled manner,” says Chris. “But they often require support with identifying how much they should gift and when they should do it.”

Gifts considered “outside” an estate include those between spouses and civil partners, gifts of up to £3,000 per year, and those of £250 or less per person, per year – as long as you haven’t used another allowance on the same person.

One popular option is to gift money to your children for specific purposes, such as buying property, funding education or setting up a business. An added advantage with this is you get to see your loved ones benefit. Gifts towards a wedding benefit from an allowance of up to £5,000 from each parent, £2,500 from each grandparent and £1,000 from anybody else.

A common way for individuals to gift is using a trust, which they may also become a trustee of. This enables you to retain a degree of oversight over how the money is distributed to your children and beneficiaries.

Another option is to move the assets into a family investment company – a corporate structure in which your family members become shareholders. The company can be set up to divide ownership and voting control according to your wishes.

It’s important to note that, with any non-exempt gift you make, you must survive seven years before it qualifies for the zero percent rate.

- Invest it

Some investments are exempt from IHT entirely. These include Alternative Investment Market companies, Enterprise Investment Schemes, Seed Enterprise Investment Schemes, Agricultural Property Relief and Business Relief qualifying shares.

The latter provides a good example of the rationale behind IHT-exempt investments. Business Relief is a system designed to aid succession in family businesses and stimulate investment into British companies. Here, any investment into a qualifying company is exempt from IHT after only two years. You don’t need to run your own business to benefit either; reputable providers now offer portfolio companies in which anyone can buy shares.

Another advantage is that you retain direct access to the assets, unlike putting money into a trust or setting up a corporate vehicle. This can be reassuring if you’re concerned about the potential cost of future care, or about giving away too much of your wealth too soon. You can also continue to draw an income from these shares or sell them to fund future expenses.

- Give it to charity

Any gift made to charity during your lifetime is immediately exempt from IHT. If you leave a portion of your estate to charity in your will, you can also reduce the rate of IHT applied to the rest of your estate.

For example, if you leave 10 percent of your estate to charity, the 40 percent rate of IHT that would apply to the rest reduces to 36 percent.

It’s worth factoring this into your will, as well as investigating tax-exempt vehicles such as charitable trusts or foundations.

The beauty of giving money to causes you care about is that, as you begin to set aside money during your lifetime, you can see it being put to work, and take satisfaction in the difference it’s making.

- Insure it

You may decide you don’t want to give up any or all of your assets during your lifetime, but still wish to minimise the IHT bill.

One solution is taking out a whole-of-life insurance policy, which pays out after your passing and can be used to pay off all or some of the IHT liability.

“Insurance can mean that, should anything happen to you in the next 10, 15, 20 years, your IHT liabilities are covered,” says Chris. “This can provide you with certainty – and peace of mind. But you need to start early, as the cost of your policy will largely be dictated by your age and health.”

Fail to prepare, prepare to fail

IHT mitigation doesn’t have to be complex. Engaging with an experienced wealth advisor can help you build a holistic wealth plan that meets your needs both now, and in the future.

“It all starts with a conversation” says Chris. By identifying a client’s goals in four key areas – career, family, lifestyle and property – we can build the best combination of strategies for them and their family, while ensuring their plan evolves to serve their needs as they change.

Yet the process of mitigating the impact of IHT can be a hard one to start.

“These are difficult conversations,” says Chris. “They involve considering your own mortality, and it can be all too easy to end up kicking the can down the road as a result. But if you don’t tackle IHT promptly and properly, you may land your family with a heavy administrative and financial burden, at a time of deep emotional stress.”

Proper planning will never completely remove the emotion from the situation, but a proactive, incremental approach to IHT will make the process much easier for you – and dramatically reduce the strain on your loved ones.