Fixed fire protection systems such as sprinklers are an effective way to control or suppress a fire in its early stages, limiting the potential loss to the property and the business, as well as the risk to life. However, to be effective, fire protection systems need to be:

- Available (not impaired)

- Reliable (maintained)

- Adequate

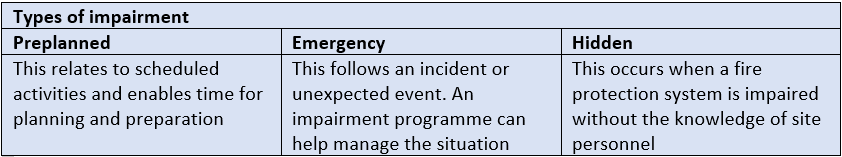

Fire protection impairments continue to be one of the most common reasons for sprinkler failure and this risk needs to be addressed with a robust fire protection impairment programme.

Understanding the risk:

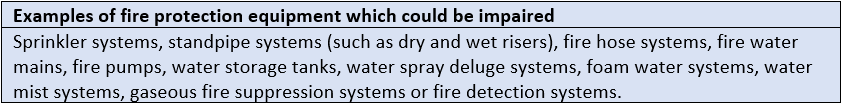

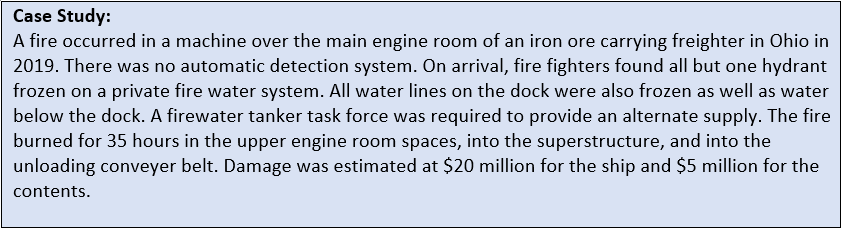

Buildings with adequate sprinkler protection are considered more favourably by property insurers because of their reduced property risk and expected loss in case of an event. But this assessment is compromised in case of a fire protection impairment as this will increase the likelihood of an uncontrolled fire. Something as simple as a closed valve, isolated pump or leaking pipe could result in the fire protection system not operating as intended, allowing the fire to grow quickly beyond the capability of on-site fire teams or fire brigade.

An effective fire protection impairment programme can help:

- Identify if a fire protection impairment is planned (or has occurred)

- Minmise the extent of the impairment

- Minmise the duration of the impairment

- Manage the risk of fire during the impairment

Managing the risk:

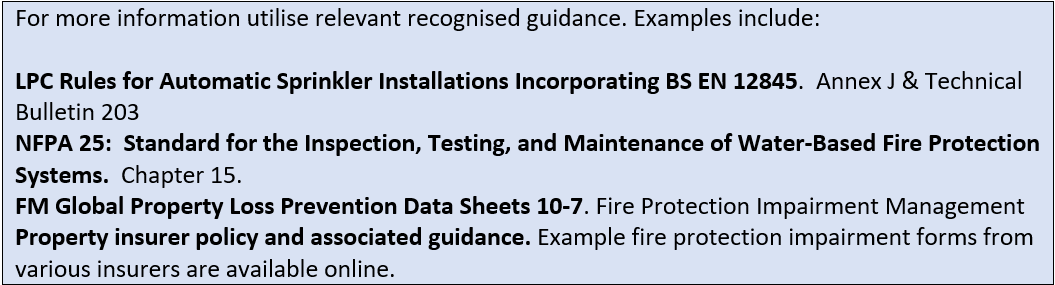

A fire protection impairment programme should include the requirements, permit and notification processes specified by your property insurance company. Key considerations include:

- Assign an impairment co-ordinator

- Utilise a tag system to indicate if a system or part of a system is removed from service

- Verify suitable procedures are in place to manage fire risk during an impairment. These might include additional measures such as removal of personnel, assigning a fire watch, providing a temporary water supply, implementing aprogramme to avoid ignition sources or hazardous processes and limiting the presence of combustible materials.

- Implement a process to notify relevant stakeholders such as the fire brigade, insurance carrier, property owner and any other authorities having jurisdiction.

- Provide a process to ensure impaired equipment is restored to working order and stakeholders are notified.

Commercial property insurers typically expect facilities with fixed fire protection systems to have a fire protection impairment system in place and be notified of impairments, particularly where sprinklers are required or where a premium discount has been applied.

For further information, please visit the Lockton Risk Control page(opens a new window).

For further information, please visit the Lockton Risk Control page(opens a new window).